Understanding the DXY: A Comprehensive Guide to the U.S. Dollar Index Chart on TradingView

Table of Contents

- US Dollar Index DXY long term longs

- The Dollar Index DXY: What Is It? — Fxonline.AI

- 💲Learn DXY - US. Dollar Index for OANDA:XAUUSD by UnitedSignals ...

- DXY ใกล้ถึงจุดสำคัญในราคา, เวลา - THAIFRX.com

- DXY Weekly Price Outlook: Is the Reign of King Dollar Over?

- DXY forecast as the US dollar index pulls back

- DXY: US dollar index could surge to 6.50 - ING

- US Dollar Index News: DXY Retreats from 10-Month High Amid Euro's Rebound

- Dollar Index Chart - DXY Quote — TradingView

- US dollar index (DXY) forecast: consumer confidence, FOMC, NFP data

What is the DXY?

- Euro (EUR) - 57.6% weightage

- Japanese Yen (JPY) - 13.6% weightage

- Pound Sterling (GBP) - 11.9% weightage

- Canadian Dollar (CAD) - 9.1% weightage

- Swedish Krona (SEK) - 4.2% weightage

- Swiss Franc (CHF) - 3.6% weightage

Why is the DXY Important?

- Foreign exchange rates

- International trade

- Commodity prices

- Interest rates

- Stock markets

Analyzing the DXY Chart on TradingView

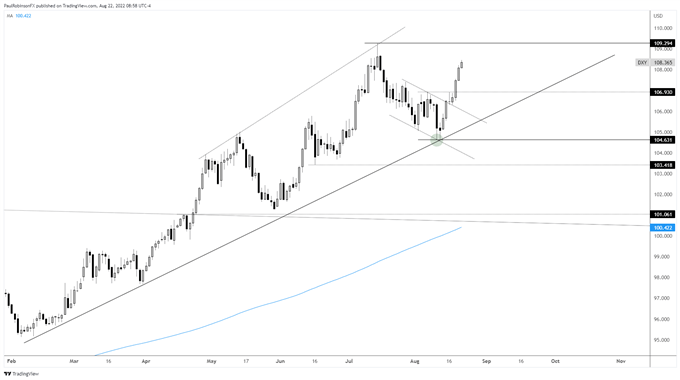

TradingView is a popular platform for technical analysis and charting. The DXY chart on TradingView provides a wealth of information for traders and investors. Here are some key features to look out for:- Trend lines: Identify trends and patterns in the DXY index, such as support and resistance levels.

- Indicators: Apply technical indicators, such as moving averages, RSI, and Bollinger Bands, to gauge the DXY's momentum and volatility.

- Candlestick patterns: Look for bullish or bearish candlestick patterns, such as hammer, shooting star, or engulfing patterns, to predict potential reversals or continuations.

- News and events: Stay up-to-date with news and events that may impact the DXY, such as economic indicators, central bank decisions, and geopolitical developments.

Stay ahead of the curve and start analyzing the DXY chart on TradingView today!